federal income tax liabilities

How do I know if I had federal income tax liability. How do I know if I had federal income tax liability.

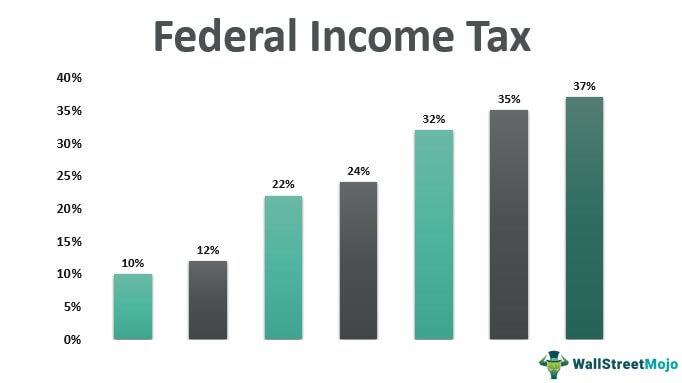

Federal Income Tax Graph Union College Vita Training

Our income tax calculator calculates your federal state and local taxes based on several key inputs.

. Use this tool to. Your total tax liability is the combined amount of. Ad Compare Your 2022 Tax Bracket vs.

A tax liability is a tax debt you owe to a taxing authorityaka the IRS state government or local government. Appropriately line 37 says. An individual income tax or personal income tax is levied on the wages salaries investments or other forms of income an individual or household earns.

Estimate your federal income tax withholding. Discover Helpful Information And Resources On Taxes From AARP. He opts for a standard deduction and plans to file as a single individual.

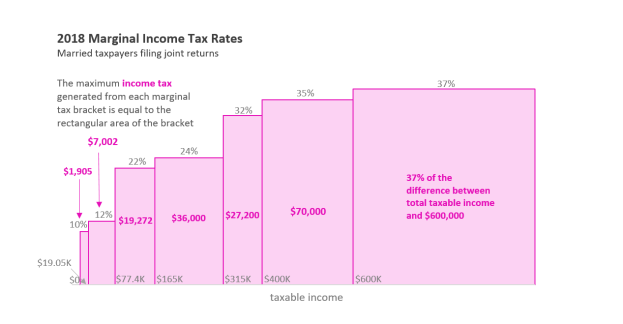

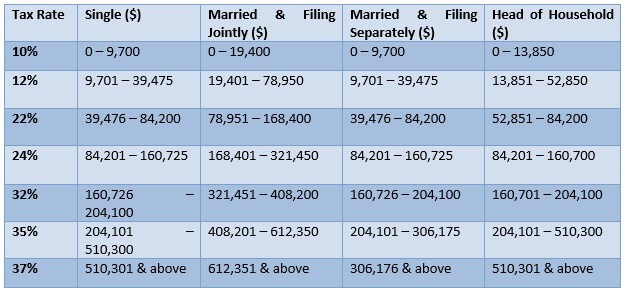

Tax liability is the total amount of tax debt owed by an individual corporation or other entity to a taxing authority such as the Internal. A tax liability is the amount of taxation that a business or an individual incurs based on current tax laws. The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax brackets.

Federal Personal Income Tax Liabilities and Payments 195997 By Thae S. Effective tax rate 172. Tax Liability Definition.

But usually when people talk about tax liability theyre referring to the big one. Your tax liability isnt based on your overall earnings but on. A taxable event triggers a tax liability calculation.

Tax solution is within reach. What is federal tax income liabilities. See how your refund take-home pay or tax due are affected by withholding amount.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Based on this information and the. You can find your tax liability for the year on lines 37 and 38 of the revised 2020 Form 1040.

Your household income location filing status and number of personal exemptions. Your total tax liability is the total amount of tax you owe from. This article presents estimates of Federal personal income tax liabilities and estimates of Federal.

You can find your tax liability for the year on lines 37 and 38 of the revised 2020 Form 1040. Get Free Competing Quotes For Tax Relief Programs. Depending on your income you may or may not.

Your tax liability is what you owe to the IRS or another taxing authority when you finish preparing your tax return. In general when people refer to. To be exempt from withholding both of the following must be true.

The definition of tax liability is the amount of money or debt an individual or entity owes in taxes to the government. Get free competing quotes tax advice from the best. Free 2-Day Shipping wAmazon Prime.

Each state may use different regulations you should check with your state if you are interested. Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal income tax brackets and rates. Your 2021 Tax Bracket To See Whats Been Adjusted.

What Is a Total Tax Liability. So if your total tax on Form 1040 is smaller than your. Ad Read Customer Reviews Find Best Sellers.

Federal income tax liability is the amount of tax you owe to the federal government on your annual earned income. A Limited Liability Company LLC is a business structure allowed by state statute. Appropriately line 37 says.

You expect to owe no federal income tax in the current tax year. Ad Have Tax Liability Issues. Peters adjusted gross income is 65000.

Summary Of The Latest Federal Income Tax Data Tax Foundation

Who Pays Income Taxes Foundation National Taxpayers Union

How A Billionaire Pays 0 In Federal Income Tax By Kr Franklin Datadriveninvestor

How Much Can A Family With 2 Kids Earn And Still Pay Zero Federal Income Taxes The Homa Files

Calculating Income Tax Liability

How Is Tax Liability Calculated Common Tax Questions Answered

Federal Income Tax Definition Rates Bracket Calculation

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Am I Exempt From Federal Taxes R Personalfinance

Childless Adults Are Lone Group Taxed Into Poverty Center On Budget And Policy Priorities

Federal Income Tax Liability In 2018 What Does That Mean I M Having A Really Hard Time Figuring Out What Numbers To Put In What Boxes

The Tcja Is Increasing The Share Of Households Paying No Federal Income Tax Tax Policy Center

It S About Your Total Tax Liability Not Your Refund Tax Policy Center

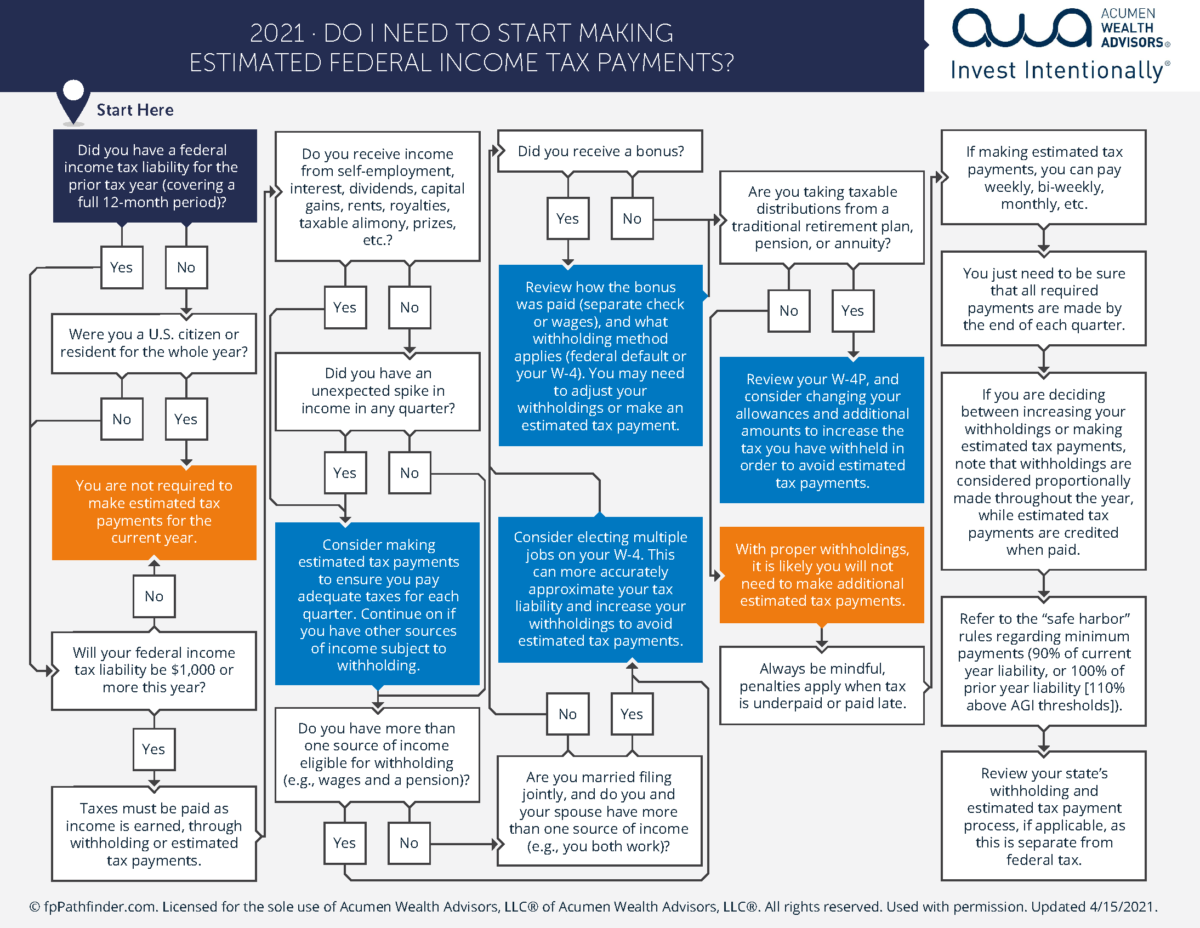

Flowchart Do I Need To Start Making Estimated Federal Income Tax Payments For 2021 Acumen Wealth Advisors

Federal Income Tax Calculator Atlantic Union Bank

California Tax Expenditure Proposals Income Tax Introduction

/IRS-4e41b1914e44408786b4537951deabcd.jpg)