are inherited annuity distributions taxable

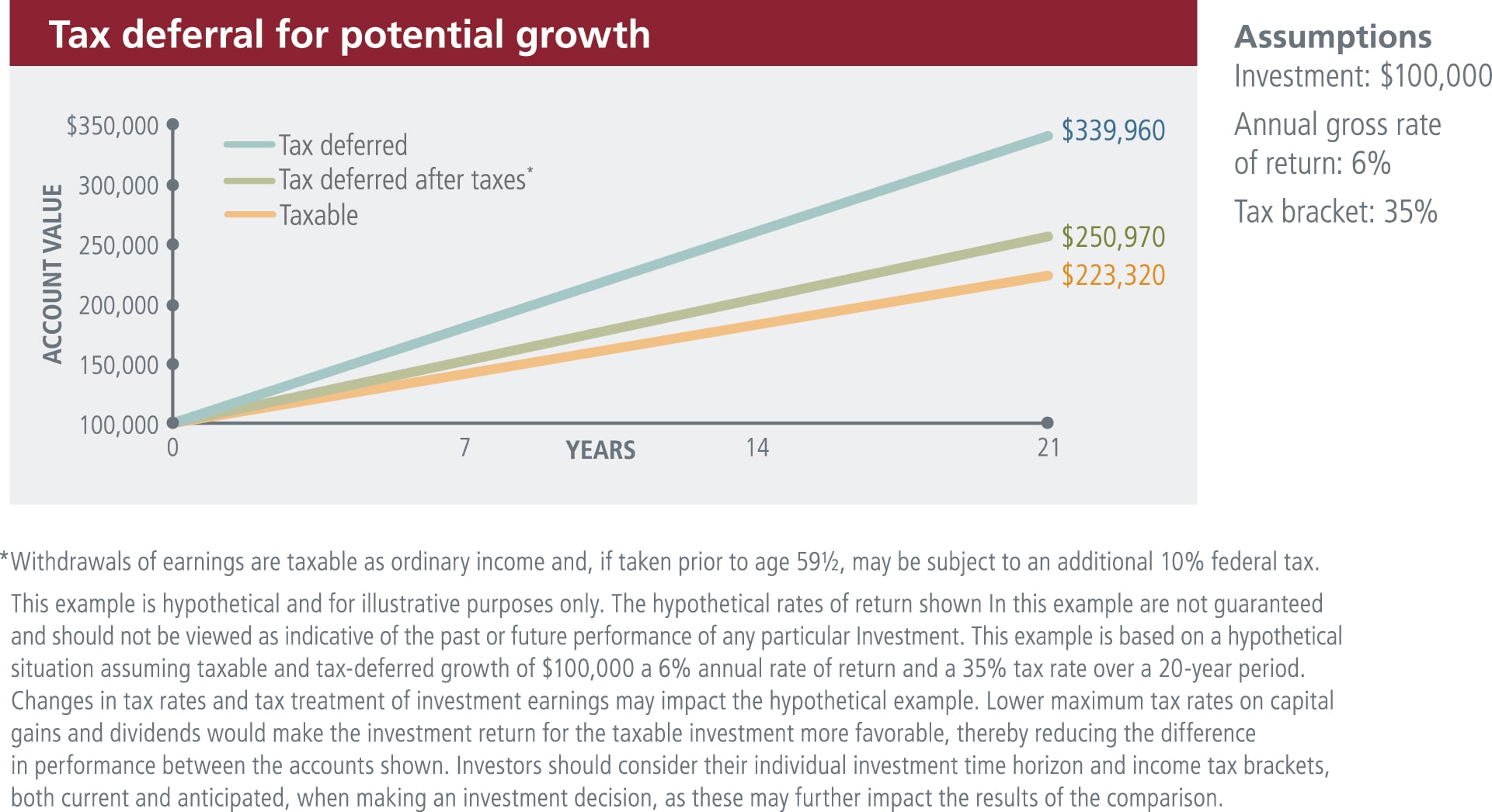

Qualified Inherited Annuities All death benefits will be subject to taxes. Tax-deferred means you will pay ordinary income tax on the earnings portions of your distributions.

A Tax Deferred Annuity 101 Guide For Non Biased Consumers Due

Build Your Future With a Firm that has 85 Years of Retirement Experience.

. Youll pay tax on everything above the cost that the original annuity. However there are no RMD issues and you wont have that 10 early. Your contribution went in first and the earnings were.

Ad Get this must-read guide if you are considering investing in annuities. The earnings are taxable over the life of the payments. Annuities are taxed as ordinary income when inherited.

Ad Questions Answered Fast. Nonqualified Inherited Annuities Only the interest earned will be subject to taxes. Most likely the entire amount of any tax-sheltered annuity TSA you inherit will be taxable.

Annuities are often complex retirement investment products. Ad Learn More about How Annuities Work from Fidelity. You also must keep the tax.

The proceeds of inheritance are taxable. Like the original owner the beneficiary generally will not owe tax on the assets in the IRA until he or she receives distributions from it. So for instance if the annuity has 50000 in gains and 50000 in principal you wont receive the tax-free principal until after youve received all of the gains.

Will I Have To Pay Taxes On The Annuity I Inherited From My Parent. You are also required to take distributions from the annuity pursuant to the applicable required minimum distribution RMD rules. The beneficiary has several options regarding how to receive the inherited annuity depending on your relationship to the annuity owner spouse or non-spouse.

In that case the taxation is much simpler. Inherited Annuity ddemarino The federal tax on the distribution would be at her marginal tax rate which could be 10 12 22 24 or more. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds.

Ad Understanding Variable of Annuities Can be Confusing. Either way you will pay regular taxes only on the interest. If youre not the spouse of the deceased you basically have two options for taking.

Get 1-on-1 Tax Answers Online Save Time. Learn some startling facts. The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded with money that was already subject to taxes will still not be taxed.

If a beneficiary opts. When taking a lump-sum distribution from a non-qualified annuity the IRS treats the withdrawal as last-in-first-out LIFO. Often those inheriting an annuity choose a lump-sum payout.

Inherited Non-Qualified Annuity Taxes. It would depend on her taxable income. Ad Make a Thoughtful Decision For Your Retirement.

Inherited ROTH IRAs Generally the entire. An individual who inherits a non-qualified annuity can take a lump-sum cash payment or a stream of payments. Read About Variable Annuities Today.

Use this Guide to Learn if a Variable Annuity Product Fits Best with Your Financial Goals. Ad Learn More about How Annuities Work from Fidelity.

How Are Annuities Taxed For Retirement The Annuity Expert

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Inherited Annuity Tax Guide For Beneficiaries

Inherited Annuity Tax Guide For Beneficiaries

Annuity Taxation How Various Annuities Are Taxed

Annuity Beneficiaries Inherited Annuities Death

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

Qualified Vs Non Qualified Annuities Taxes Distribution

Annuity Beneficiaries Inheriting An Annuity After Death

Do I Have To Annuitize My Annuity Income Annuity Annuity Quotes Lifetime Income

Taxation Of Annuities Explained Annuity 123

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Annuity Beneficiaries Inheriting An Annuity After Death

Qualified Vs Non Qualified Annuities Taxation And Distribution

Annuity Beneficiaries Inheriting An Annuity After Death